Buying a Home This Season? Why You Should Avoid Holiday Debt

The holiday season is an exciting time filled with gift-giving, celebrations, and family traditions. But for homebuyers—whether you’re currently pre-approved for a mortgage or planning to buy in the next six months—the holidays can also be a risky time for your financial health.

Holiday spending, if not managed properly, could derail your chances of securing a mortgage or delay your homeownership goals. By avoiding holiday debt, you can keep your home-buying plans on track and protect your financial future.

In this article, we’ll cover the reasons holiday debt can be detrimental to your mortgage approval and provide practical tips on how to navigate the holiday season without compromising your home-buying journey.

How Holiday Debt Can Ruin Your Homebuying Plans

For both homebuyers already pre-approved for a mortgage and those planning to buy in the near future, holiday debt can have serious consequences. While a small splurge on gifts may seem harmless, even minor financial missteps could lower your credit score or impact your debt-to-income ratio—two critical factors lenders consider during the home-buying process.

Lenders often perform debt monitoring even after you’ve been pre-approved. They watch your credit activity and financial behavior closely until the loan closes. If you’re still months away from buying a home, holiday overspending could leave you with debts that take longer to pay off, delaying your ability to secure a mortgage later.

Here’s how common holiday spending habits can wreak havoc on your financial readiness to buy a home.

1. Avoid Opening New Lines of Credit

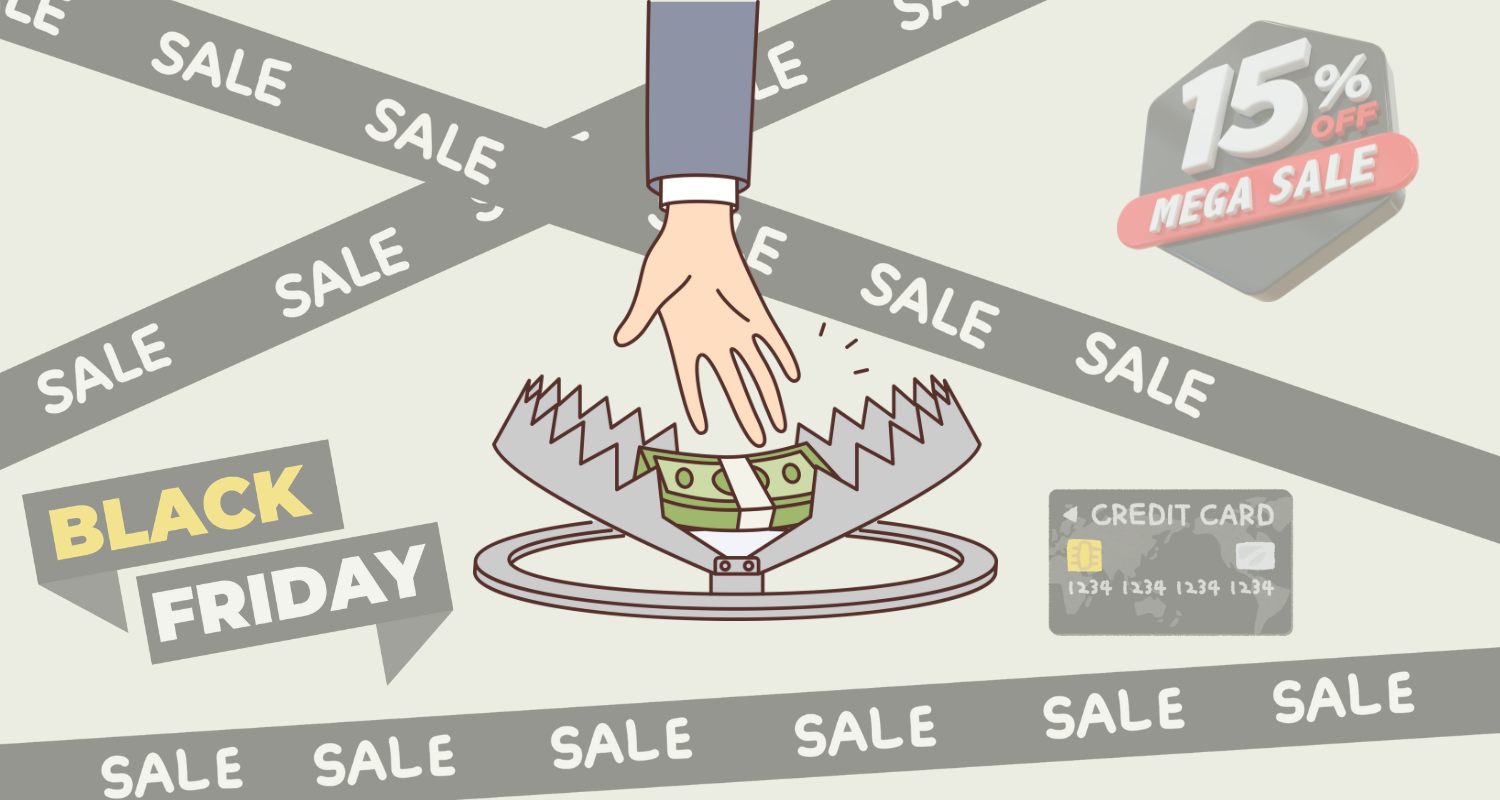

During the holidays, retailers love to entice customers with credit card offers, promising discounts and special deals. While it might be tempting to open a store credit card to save 15% on your purchase, this seemingly small decision could damage your chances of buying a home.

For pre-approved buyers, opening a new line of credit triggers a hard credit inquiry, which can lower your credit score. Even a slight dip could cause lenders to reevaluate your loan approval. Plus, any new credit affects your debt-to-income ratio, which could result in a denial of your mortgage right before closing.

For buyers 6 months or more out, opening new lines of credit now will increase your overall debt. This debt can take months to pay off, raising your debt-to-income ratio when you finally apply for a mortgage.

2. Refrain from Large Purchases

We all love holiday sales, and it’s easy to get swept up in purchasing big-ticket items like new furniture, electronics, or that discounted flat-screen TV. But making large purchases during the holidays is a financial risk if you’re serious about buying a home.

For pre-approved buyers, large purchases could immediately reduce the cash reserves that lenders require you to maintain. Some lenders will deny your loan if you deplete these reserves by spending on holiday deals, even if you’ve already been pre-approved.

For future buyers, spending large amounts during the holiday season can reduce the savings you’ve been working hard to accumulate for a down payment. It’s crucial to save, not spend, if you want to be ready to buy in the coming months.

3. Don’t Move Large Sums of Money

Transferring money between accounts or depositing large sums during the holiday season may seem innocent, but it can complicate things for lenders. They need to verify the source of funds, and any unusual financial activity could raise red flags.

For pre-approved buyers, large deposits or withdrawals could delay your loan approval. Your lender needs a clear picture of your financial situation, and unexplained changes could slow down the process or lead to additional questions.

For buyers still saving, large money transfers could complicate your ability to save effectively, especially if these funds are used for non-essentials. Keep your finances stable and transparent to avoid problems when you’re ready to apply for a mortgage.

4. Stay on Top of Your Bills

It’s easy to get distracted during the holiday season, but neglecting bills or making late payments could severely impact your credit score. Lenders closely monitor your payment history, and any missed or late payments could result in a lower credit score.

For pre-approved buyers, one missed bill could lower your score by as much as 110 points, putting your entire mortgage approval at risk. You’ll also need to explain to your lender why the payment was missed, which could delay your closing.

For future buyers, holiday overspending could make it harder to pay bills on time. Even one late payment could negatively affect your credit score and delay your home purchase for months.

5. Resist Using Your Savings for Holiday Spending

It’s tempting to dip into your savings for holiday shopping, especially if you find the perfect gift or deal. But doing so could cause significant setbacks in your home-buying journey.

For pre-approved buyers, using your savings for holiday expenses can deplete your down payment funds, putting your loan approval in jeopardy. Lenders want to see stable reserves, and spending those savings could cause them to reconsider your loan.

For future buyers, tapping into your house savings now can delay your ability to afford a down payment when you’re ready to buy. Keep your savings intact by creating a separate holiday spending account to avoid temptation.

Smart Strategies for Holiday Spending While House Hunting

It’s still possible to enjoy the holiday season without wrecking your financial future. Here are some strategies to help you stay on track:

Make a Budget and Stick to It

Whether you’re already pre-approved or still saving, a holiday budget is essential. Determine how much you can spend on gifts, decorations, and events, and stick to that number. Using cash instead of credit cards can help keep your spending in check and prevent you from adding unnecessary debt.

Get Creative with Gift Giving

Consider non-traditional gift-giving ideas to reduce your holiday spending. For example, organizing a Secret Santa with family or friends can help lower your gift-buying expenses. Homemade gifts or experience-based gifts, like planning a special outing, can be thoughtful yet affordable alternatives to expensive presents.

Think Like a Future Homeowner

Even if you’re months away from buying a home, start thinking like a homeowner now. If friends or family ask what you’d like for the holidays, consider asking for items that will help you in your new home. Gift cards to home improvement stores, kitchen appliances, or home décor can all be helpful once you move in.

Keep Your Eye on the Prize — Your New Home

Holiday spending is temporary, but buying a home is a long-term investment that will benefit you and your family for years to come. Whether you’re pre-approved or months away from buying, staying financially disciplined during the holiday season is essential. Avoid accumulating holiday debt, stay on top of your bills, and save as much as possible so that your home-buying dream becomes a reality.

By following these strategies, you can enjoy the holidays while keeping your homeownership goals firmly in sight. Your future self—relaxing in your new home—will thank you for it!